Los Angeles County & Orange County

Investing in 2-4 Unit Multifamily Properties in Los Angeles & Orange County (2025)

Thinking about investing in a duplex, triplex, or fourplex? Southern California’s 2-4 unit market remains a prime opportunity for both new and seasoned investors. Below, you’ll find the latest trends, rent data, and investment insights for Los Angeles and Orange County—right before beginning your search for available properties.

Why 2-4 Units?

These properties offer a perfect balance of scalability, rental income, and financing flexibility. Investors can live in one unit, rent the rest, and often qualify for attractive residential loans.

Los Angeles County

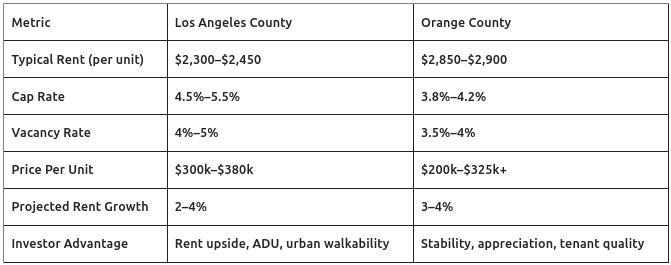

Los Angeles County draws attention for its diverse neighborhoods, strong tenant demand, and high potential for value-add improvements such as adding accessory dwelling units (ADUs). In 2025, vacancy rates are below 5%, with average rents for 2-4 unit buildings between $2,300 and $2,450 per month. Typical cap rates range from 4.5% to 5.5%, and properties sell for $300,000–$380,000 per unit in central locations. While rent control adds complexity, the promise of robust rent growth and high walkability makes LA a hotspot for those seeking long-term returns and urban investment opportunities.

Orange County

Orange County is known for its stability, high-quality tenants, and exceptionally strong appreciation. Demand for small multifamily buildings is steady in areas like Anaheim, Costa Mesa, and Irvine. Expect very high occupancy (96%+) and average monthly rents near $2,900. Cap rates tend to be a bit lower, averaging 3.8%–4.2%, with premium properties in coastal and desirable neighborhoods selling for $200,000–$325,000+ per unit. The market is highly competitive but benefits include low turnover and strong appreciation over time.

Key Comparisons

What Should Investors Know?

- LA County: Higher yields, more value-add opportunities, and diverse neighborhoods, but added regulations to navigate.

- Orange County: Lower risk, premium tenant base, and excellent long-term value, though initial cash flow may be lower.

- Both counties offer enduring renter demand and strong long-term appreciation prospects.

Ready to explore available duplex, triplex, and fourplex investments? Use the search below to review live multifamily listings in your target neighborhoods, or reach out for personalized guidance!